From SaaS to COGSware: Why the AI cognition economy changes everything about software margins

Back at the turn of the century, when I was a product manager at Lucent Technologies building xDSL models (does anyone remember what those were?), my favorite part of the job was sitting at the intersection of sales and finance to manage product P&Ls. Everything revolved around one critical concept: understanding and optimizing your Cost of Goods Sold (COGS)—the direct costs of producing each unit you sell.

In the physical product world, COGS includes materials, manufacturing, and labor. The strategic beauty was that you could model your pricing over time by anticipating cost leverage from scale. As volumes increased, unit costs decreased through better procurement deals and manufacturing efficiencies. You could enter markets with razor-thin margins, confident that scale would eventually drive profitability.

When I later moved to New York and got involved in service and SaaS businesses, I was honestly bewildered by how COGS simply disappeared. Once you built the software, serving customer #1,000 cost essentially the same as serving customer #1. No materials, no manufacturing, no variable costs per user—just beautiful, scalable margins approaching 100%. It felt like economic magic.

For two decades, this magic held. Software had transcended the physical world's constraints.

But AI has brought us full circle. Software has rediscovered COGS.

AI Breaks the Magic

The economic magic of software didn't last. AI has reintroduced the COGS reality that software escaped for twenty years. Every time your app calls an AI model, every automated task, every smart recommendation—it all costs money that scales with usage, just like manufacturing physical products.

As I explored in "The Agent is the Internet", we are transitioning from a web of pages to a web of behaviors. COGSware is the economic substrate that makes this behavioral transformation possible—and costly.

The era of unlimited margins is over. The era of COGSware—software with meaningful Cost of Goods Sold—has begun.

From Physical to Digital to Physical Again

To understand this shift, consider how software distribution evolved:

Phase 1: Physical Distribution (1980s-1990s) Software came on floppy disks, then CD-ROMs. Every copy sold required physical manufacturing, packaging, and distribution. Unit economics were inescapable—more customers meant more costs.

Phase 2: The Digital Liberation (2000s-2010s) The internet eliminated physical constraints and COGS. Software became pure information—infinitely copyable at zero marginal cost. SaaS emerged as the perfect model: build once, serve infinitely, with gross margins approaching 90%.

Phase 3: The Return of COGS (2020s-present) AI brought back variable costs to software. Every user interaction now requires expensive computational processing. We've returned to unit economics that look remarkably similar to physical products—but instead of manufacturing costs, we're paying for cognitive processing.

This brings us full circle back to the COGS management I practiced at Lucent, but with a crucial difference: unlike physical manufacturing where scale typically reduces unit costs, AI processing costs scale linearly with usage. There's no volume discount on cognition—at least not yet.

The COGS Problem in AI Applications

AI apps reintroduce the variable cost structure that SaaS eliminated. When users interact with your app, your app has to call AI services that charge per use. This creates what I call the AI COGS problem—your direct costs scale with user engagement, just like in physical product businesses.

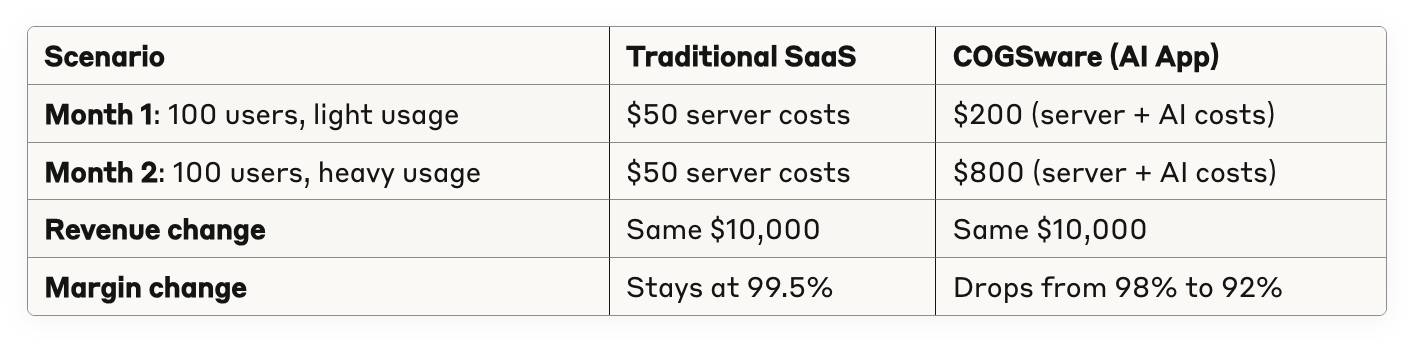

Here's a simple example that shows the difference:

Traditional SaaS worked the opposite way: more usage meant better profit margins because there were essentially no variable costs. AI apps face the reverse: more usage can mean worse margins unless you actively manage your COGS, just like any physical product business.

This tracks the transformation I outlined in "The End of Browsing"—when browsing becomes delegation and interfaces become agents, the economic logic changes fundamentally. Browsing was free; cognitive delegation is not.

COGSware: Software with Real Operating Costs

COGSware stands for software with meaningful Cost of Goods Sold—apps that look like normal software but have real per-user costs that traditional software avoided.

The business implications are huge:

More users might hurt profits: High usage could mean losing money on popular features

Growth becomes complicated: You can't just focus on getting more users—you need profitable users

Operations matter more: How efficiently you run AI features directly affects your business success

The Coming Price Squeeze: Why Model Provider Lock-in is Inevitable

Here's an uncomfortable truth that most AI startups aren't discussing: the companies providing AI models (OpenAI, Anthropic, Google) hold all the pricing power. And they will almost certainly use it.

Think about the dynamics at play:

Limited suppliers: Only a handful of companies can provide state-of-the-art AI models

High switching costs: Changing AI providers means rewriting prompts, retraining workflows, and potentially degraded performance

Growing dependency: As your product becomes more AI-native, you become more dependent on these providers

Market consolidation: The AI model market is likely to consolidate further, not expand

This creates a classic supplier power scenario. Once AI companies have built successful businesses on top of these platforms, model providers can—and likely will—raise prices significantly. It's not a matter of if, but when.

We've already seen early signs with OpenAI adjusting pricing multiple times. As the market matures and competition among AI apps intensifies, expect model providers to capture more value through pricing.

What This Means Right Now: A Reality Check for Founders and Investors

For Founders: The New Operating Playbook

Rethink your pricing model immediately. That usage-based pricing that seemed clever? It might be killing your margins. Consider hybrid models: base subscription + usage tiers with built-in margin protection.

Build cost tracking into your product from day one. Set up real-time cost monitoring that shows you which users, features, and workflows make money vs. lose money. This isn't a nice-to-have—it's essential for survival.

Make your AI features efficient. The winning companies aren't just building better AI features—they're building cheaper AI features. This means optimizing prompts, routing simple tasks to cheaper AI models and complex ones to expensive models, caching results, and preprocessing data to reduce expensive AI calls.

Prepare for supplier price increases. Build multi-provider architecture from day one. Design your system to easily switch between OpenAI, Anthropic, Google, and others. The switching cost should be configuration, not reengineering.

For Investors: The New Due Diligence Questions

Stop asking just about ARR growth. Start asking about margin-adjusted ARR. A company with $1M ARR at 30% gross margins is fundamentally different from one with $1M ARR at 80% gross margins.

Stress-test the unit economics under different scenarios. What happens to margins if OpenAI raises prices 50%? What if usage scales 10x overnight?

Look for teams that understand AI cost management. The best COGSware companies are getting sophisticated about managing AI expenses. They're building internal tools to track costs, experimenting with different AI providers, and treating AI infrastructure like any other business expense that needs to be optimized.

The New Measurement Framework: Metrics That Actually Matter

Traditional SaaS metrics can be actively misleading in the COGSware world. Here are the metrics that successful AI-native companies are tracking instead, with formulas you can implement immediately:

Gross Margin Volatility (GMV)

What it measures: How much your margins swing when upstream costs change

Formula:Standard Deviation of Monthly Gross Margins over 12 months

Data inputs: Monthly gross margin % for the past 12 months

Good/Bad threshold: <5% is stable, >15% is dangerousModel Exposure Ratio (MER)

What it measures: Your dependency on any single AI provider

Formula:Primary Provider Costs / Total AI Infrastructure Costs × 100

Data inputs: Monthly costs by AI provider (OpenAI, Anthropic, etc.)

Good/Bad threshold: <70% is diversified, >90% is extremely riskyCost-per-Value-Unit (CPVU)

What it measures: How much each unit of customer value costs you to produce

Formula:Total AI Costs / Total Value Units Delivered

Data inputs: Monthly AI infrastructure costs, count of value units (reports, conversations, analyses)

Good/Bad threshold: Should decrease over time as you optimizeMargin-Adjusted Monthly Recurring Revenue (MA-MRR)

What it measures: Revenue that actually contributes to your bottom line

Formula:Σ(Customer MRR × Customer Gross Margin %)

Data inputs: Individual customer MRR, individual customer margins

Good/Bad threshold: Should grow faster than traditional MRR

Real-World Examples: COGSware in Action

The Good: A legal tech startup routes document review to cheaper models but uses premium models for legal analysis. They've achieved 60% gross margins by treating different cognitive tasks as different cost centers.

The Bad: An AI writing tool let users generate unlimited content with no usage guardrails. High engagement looked great until they realized their top 10% of users were generating 80% of costs while paying the same subscription fee as light users.

The Ugly: A customer service AI company scaled to $2M ARR but discovered their margins were actually negative because they hadn't optimized their conversation flows. Every customer interaction was hitting expensive models multiple times unnecessarily.

The Opportunity: Why This Matters for Your Next Investment or Startup

The founders and investors who understand COGSware economics first will build the most valuable and sustainable businesses of the next decade.

But they'll do it differently than traditional software companies. Instead of "grow as fast as possible," they'll practice "grow profitably." Instead of maximizing how much people use the product, they'll optimize for valuable usage that actually makes money.

The traditional startup playbook of growth-at-any-cost doesn't work when costs grow with usage. The new playbook requires smart scaling—growing deliberately while keeping costs under control.

This creates new ways to win:

Running efficient operations becomes a real competitive advantage

Technical efficiency directly improves your business model

Teaching customers to use your product profitably becomes a key strategy

The Bigger Picture: From Information to AI

This economic shift reflects something bigger happening in how we use technology. We're moving from an information economy to a cognition economy—from looking up data to having AI do thinking for us.

In my previous writing, I've discussed how we're transitioning from the computing age of information to the age of AI-powered cognition (see "Farewell, Web 4.0"). COGSware is what this transition looks like from a business perspective. When apps become AI assistants, when looking things up becomes asking AI to figure things out—costs follow.

This isn't just about software—it's about AI becoming a service you pay for, like electricity or cloud hosting. COGSware companies are the first to figure out how to make this work financially.

Conclusion: The New Reality

COGSware isn't just a new type of software—it's the end of software being special. For twenty years, software existed in a unique economic space where serving more customers cost almost nothing and unlimited growth seemed possible.

AI, as our cognitive partner, has brought software back to the real world of limited resources, supply chains, and per-unit costs. This isn't a step backward; it's software growing up. The companies that understand this change first will build the most successful businesses of the next decade.

The era of unlimited margins is over. The era of managing real costs has begun.

Welcome to COGSware. Your business model will never be the same.

If you're building AI-native applications and need help modeling unit economics or preparing for rising AI costs, I'd be happy to discuss your specific situation. Feel free to reach out on LinkedIn or email me directly at chevan@vannanco.com.

This is interesting stuff. I feel like it’s a B2B reflection of the subscriptionifying (technical term) of every day life. We don’t own CDs we stream Apple Music, we don’t own movies we stream content, we don’t own Microsoft office we access 365 online. Even cars are charging subscription access to heated seats. Access over ownership is a shortsighted trade for us on the front lines but not sure we have much say in the matter so far.